8.S: Summary

- Page ID

- 28549

Key Concepts Summary

8.1: Principal, Rate, Time (How Does Interest Work?)

- Calculating the amount of simple interest either earned or charged in a simple interest environment

- Calculating the time period when specific dates or numbers of days are involved

- Calculating the simple interest amount when the interest rate is variable throughout the transaction

8.2: Moving Money Involving Simple Interest (Move and Nobody Gets Hurt)

- Putting the principal and interest together into a single calculation known as maturity value

- Altering a financial agreement and establishing equivalent payments

8.3: Application: Savings Accounts and Short-Term GICs (Safe and Secure)

- How to calculate simple interest for flat-rate and tiered savings accounts

- How to calculate simple interest on a short-term GIC

8.4: Application: Promissory Notes (A Promise Is a Promise)

- The characteristics of a promissory note

- Calculating the maturity value of a promissory note

- Selling a promissory note before its maturity date

8.5: Application: Loans (The Bank Comes Knocking)

- Demand loans, their characteristics, and the common forms they take

- Establishing a repayment schedule for demand loans

- The characteristics of a student loan and how it is repaid

8.6 Application: Treasury Bills and Commercial Papers (When Governments and Businesses Borrow)

- The characteristics of treasury bills

- The characteristics of commercial papers

- Calculating the price of T-Bills and commercial papers

- Calculating the yield of T-Bills and commercial papers

The Language of Business Mathematics

- accrued interest

-

Any interest amount that has been calculated but not yet placed (charged or earned) into an account.

- commercial paper

-

A short-term financial instrument with maturity no longer than one year that is issued by large corporations.

- compound interest

-

A system for calculating interest that primarily applies to long-term financial transactions with a time frame of one year or more; interest is periodically converted to principal throughout a transaction, with the result that the interest itself also accumulates interest.

- current balance

-

The balance in an account plus any accrued interest.

- demand loan

-

A short-term loan that generally has no specific maturity date, may be paid at any time without any interest penalty, and where the lender may demand repayment at any time.

- discount rate

-

An interest rate used to remove interest from a future value.

- equivalent payments

-

Two payments that have the same value on the same day factoring in a fair interest rate.

- face value of a T-bill

-

The maturity value of a T-bill, which is payable at the end of the term. It includes both the principal and interest together.

- fixed interest rate

-

An interest rate that is unchanged for the duration of the transaction.

- future value

-

The amount of principal with interest at a future point of time for a financial transaction. If this future point is the same as the end date of the financial transaction, it is also called the maturity value.

- guaranteed investment certificate (GIC)

-

An investment that offers a guaranteed rate of interest over a fixed period of time.

- interest amount

-

The dollar amount of interest that is paid or earned.

- interest rate

-

The rate of interest that is charged or earned during a specified time period.

- legal due date of a note

-

Three days after the term specified in an interest-bearing promissory note is the date when a promissory note becomes legally due. This grace period allows the borrower to repay the note without penalty in the event that the due date falls on a statutory holiday or weekend.

- maturity date

-

The date upon which a transaction, such as a promissory note, comes to an end and needs to be repaid.

- maturity value

-

The amount of money at the end of a transaction, which includes both the interest and the principal together.

- present value

-

The amount of money at the beginning of a time period in a transaction. If this is in fact the amount at the start of the financial transaction, it is also called the principal. Or it can simply be the amount at some time earlier before the future value was known. In any case, the amount excludes the interest.

- prime rate

-

An interest rate set by the Bank of Canada that usually forms the lowest lending rate for the most secure loans.

- principal

-

The original amount of money that is borrowed or invested in a financial transaction.

- proceeds

-

The amount of money received from a sale.

- promissory note

-

An unconditional promise in writing made by one person to another person to pay a sum of money on demand or at a fixed or determinable future time.

- repayment schedule

-

A table that details the financial transactions in an account, including the balance, interest amounts, and payments.

- savings account

-

A deposit account that bears interest and has no stated maturity date.

- secured loan

-

Those loans that are guaranteed by an asset such as a building or a vehicle that can be seized to pay the debt in case of default.

- simple interest

-

A system for calculating interest that primarily applies to short-term financial transactions with a time frame of less than one year.

- student loan

-

A special type of loan designed to help students pay for the costs of tuition, books, and living expenses while pursuing postsecondary education.

- time period

-

The length of the financial transaction for which interest is charged or earned. It may also be called the term.

- treasury bills

-

Short-term financial instruments with maturities no longer than one year that are issued by both federal and provincial governments.

- unsecured loan

-

Those loans backed up by the general goodwill and nature of the borrower.

- variable interest rate

-

An interest rate that is open to fluctuations over the duration of a transaction.

- yield

-

The percentage increase between the sale price and redemption price on an investment such as a T-bill or commercial paper.

The Formulas You Need to Know

Symbols Used

\(S\) = maturity value or future value in dollars

\(I\) = interest amount in dollars

\(P\) = principal or present value in dollars

\(r\) = interest rate (in decimal format)

\(t\) = time or term

Formulas Introduced

Formula 8.1: Simple Interest: \(I = Prt\)

Formula 8.2: Simple Interest for Single Payments: \(S = P(1 + rt)\)

Formula 8.3: Interest Amount for Single Payments: \(I = S − P\)

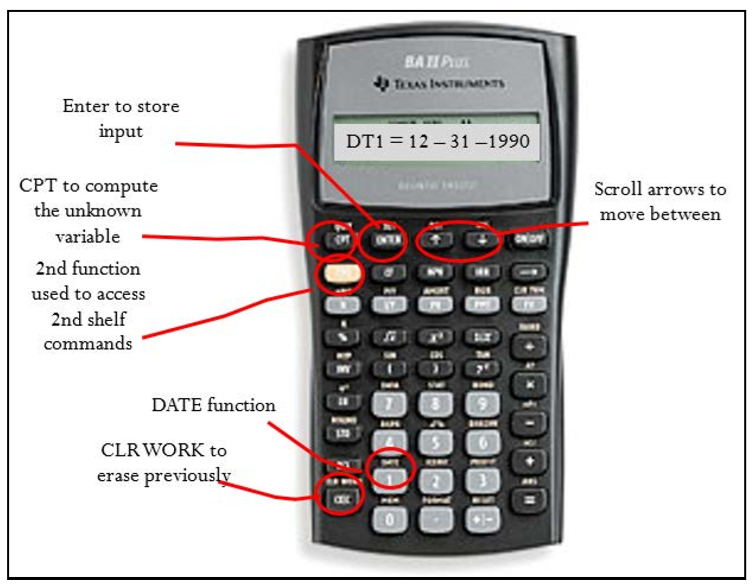

Technology

Calculator

The following calculator functions were introduced in this chapter:

Date Function

- 2nd Profit to access.

- Enter two of the three variables (DT1, DT2, DBD) by pressing Enter after each input and using and ¯ to scroll through the display. The variables are:

- DT1 = The starting date of the transaction

- DT2 = The ending date of the transaction

- DBD = The days between the dates, counting the first day but not the last, which is the time period of the transaction.

- ACT / 360 = A setting for determining how the calculator determines the DBD. In Canada, you should maintain this setting on ACT, which is the actual number of days. In other countries, such as the United States, they treat each year as having 360 days (the 360 setting) and each month as having 30 days. If you need to toggle this setting, press 2nd SET.

- Enter all dates in the format of MM.DDYY, where MM is the numerical month, DD is the day, and YY is the last two digits of the year. DD and YY must always be entered with both digits.

- Press CPT on the unknown (when it is on the screen display) to compute the answer.