7.2: Property Taxes

- Page ID

- 22104

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\( \newcommand{\dsum}{\displaystyle\sum\limits} \)

\( \newcommand{\dint}{\displaystyle\int\limits} \)

\( \newcommand{\dlim}{\displaystyle\lim\limits} \)

\( \newcommand{\id}{\mathrm{id}}\) \( \newcommand{\Span}{\mathrm{span}}\)

( \newcommand{\kernel}{\mathrm{null}\,}\) \( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\) \( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\) \( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\id}{\mathrm{id}}\)

\( \newcommand{\Span}{\mathrm{span}}\)

\( \newcommand{\kernel}{\mathrm{null}\,}\)

\( \newcommand{\range}{\mathrm{range}\,}\)

\( \newcommand{\RealPart}{\mathrm{Re}}\)

\( \newcommand{\ImaginaryPart}{\mathrm{Im}}\)

\( \newcommand{\Argument}{\mathrm{Arg}}\)

\( \newcommand{\norm}[1]{\| #1 \|}\)

\( \newcommand{\inner}[2]{\langle #1, #2 \rangle}\)

\( \newcommand{\Span}{\mathrm{span}}\) \( \newcommand{\AA}{\unicode[.8,0]{x212B}}\)

\( \newcommand{\vectorA}[1]{\vec{#1}} % arrow\)

\( \newcommand{\vectorAt}[1]{\vec{\text{#1}}} % arrow\)

\( \newcommand{\vectorB}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\( \newcommand{\vectorC}[1]{\textbf{#1}} \)

\( \newcommand{\vectorD}[1]{\overrightarrow{#1}} \)

\( \newcommand{\vectorDt}[1]{\overrightarrow{\text{#1}}} \)

\( \newcommand{\vectE}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash{\mathbf {#1}}}} \)

\( \newcommand{\vecs}[1]{\overset { \scriptstyle \rightharpoonup} {\mathbf{#1}} } \)

\(\newcommand{\longvect}{\overrightarrow}\)

\( \newcommand{\vecd}[1]{\overset{-\!-\!\rightharpoonup}{\vphantom{a}\smash {#1}}} \)

\(\newcommand{\avec}{\mathbf a}\) \(\newcommand{\bvec}{\mathbf b}\) \(\newcommand{\cvec}{\mathbf c}\) \(\newcommand{\dvec}{\mathbf d}\) \(\newcommand{\dtil}{\widetilde{\mathbf d}}\) \(\newcommand{\evec}{\mathbf e}\) \(\newcommand{\fvec}{\mathbf f}\) \(\newcommand{\nvec}{\mathbf n}\) \(\newcommand{\pvec}{\mathbf p}\) \(\newcommand{\qvec}{\mathbf q}\) \(\newcommand{\svec}{\mathbf s}\) \(\newcommand{\tvec}{\mathbf t}\) \(\newcommand{\uvec}{\mathbf u}\) \(\newcommand{\vvec}{\mathbf v}\) \(\newcommand{\wvec}{\mathbf w}\) \(\newcommand{\xvec}{\mathbf x}\) \(\newcommand{\yvec}{\mathbf y}\) \(\newcommand{\zvec}{\mathbf z}\) \(\newcommand{\rvec}{\mathbf r}\) \(\newcommand{\mvec}{\mathbf m}\) \(\newcommand{\zerovec}{\mathbf 0}\) \(\newcommand{\onevec}{\mathbf 1}\) \(\newcommand{\real}{\mathbb R}\) \(\newcommand{\twovec}[2]{\left[\begin{array}{r}#1 \\ #2 \end{array}\right]}\) \(\newcommand{\ctwovec}[2]{\left[\begin{array}{c}#1 \\ #2 \end{array}\right]}\) \(\newcommand{\threevec}[3]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \end{array}\right]}\) \(\newcommand{\cthreevec}[3]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \end{array}\right]}\) \(\newcommand{\fourvec}[4]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \\ #4 \end{array}\right]}\) \(\newcommand{\cfourvec}[4]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \\ #4 \end{array}\right]}\) \(\newcommand{\fivevec}[5]{\left[\begin{array}{r}#1 \\ #2 \\ #3 \\ #4 \\ #5 \\ \end{array}\right]}\) \(\newcommand{\cfivevec}[5]{\left[\begin{array}{c}#1 \\ #2 \\ #3 \\ #4 \\ #5 \\ \end{array}\right]}\) \(\newcommand{\mattwo}[4]{\left[\begin{array}{rr}#1 \amp #2 \\ #3 \amp #4 \\ \end{array}\right]}\) \(\newcommand{\laspan}[1]{\text{Span}\{#1\}}\) \(\newcommand{\bcal}{\cal B}\) \(\newcommand{\ccal}{\cal C}\) \(\newcommand{\scal}{\cal S}\) \(\newcommand{\wcal}{\cal W}\) \(\newcommand{\ecal}{\cal E}\) \(\newcommand{\coords}[2]{\left\{#1\right\}_{#2}}\) \(\newcommand{\gray}[1]{\color{gray}{#1}}\) \(\newcommand{\lgray}[1]{\color{lightgray}{#1}}\) \(\newcommand{\rank}{\operatorname{rank}}\) \(\newcommand{\row}{\text{Row}}\) \(\newcommand{\col}{\text{Col}}\) \(\renewcommand{\row}{\text{Row}}\) \(\newcommand{\nul}{\text{Nul}}\) \(\newcommand{\var}{\text{Var}}\) \(\newcommand{\corr}{\text{corr}}\) \(\newcommand{\len}[1]{\left|#1\right|}\) \(\newcommand{\bbar}{\overline{\bvec}}\) \(\newcommand{\bhat}{\widehat{\bvec}}\) \(\newcommand{\bperp}{\bvec^\perp}\) \(\newcommand{\xhat}{\widehat{\xvec}}\) \(\newcommand{\vhat}{\widehat{\vvec}}\) \(\newcommand{\uhat}{\widehat{\uvec}}\) \(\newcommand{\what}{\widehat{\wvec}}\) \(\newcommand{\Sighat}{\widehat{\Sigma}}\) \(\newcommand{\lt}{<}\) \(\newcommand{\gt}{>}\) \(\newcommand{\amp}{&}\) \(\definecolor{fillinmathshade}{gray}{0.9}\)As you drive through your neighborhood, you pass a city crew repairing the potholes in the road. Hearing sirens, you check your rear-view mirror and pull to the side of the road as a police car and fire engine race by, heading toward some emergency. Pulling back out, you drive slowly through a public school zone, where you smile as you watch children playing on the gigantic play structure. A city worker mows the lawn.

Where does the municipality get the money to pay for all you have seen? No one owns the roads, schools are free, fire crews and police do not charge for their services, play structures have no admission, and parks are open to everyone. These are just some examples of what your municipality does with the money it raises through property taxes.

Property Taxation

Property taxes are annual taxes paid by real estate owners to local levying authorities to pay for services such as roads, water, sewers, public schools, policing, fire departments, and other community services. Every individual and every business pays property taxes. Even if you don't own property, you pay property taxes that are included in your rental and leasing rates from your landlord.

Property taxes are imposed on real estate owners by their municipal government along with any other bodies authorized to levy taxes. For example, in Manitoba each divisional school board is authorized to levy property taxes within its local school division boundaries.

The Formula

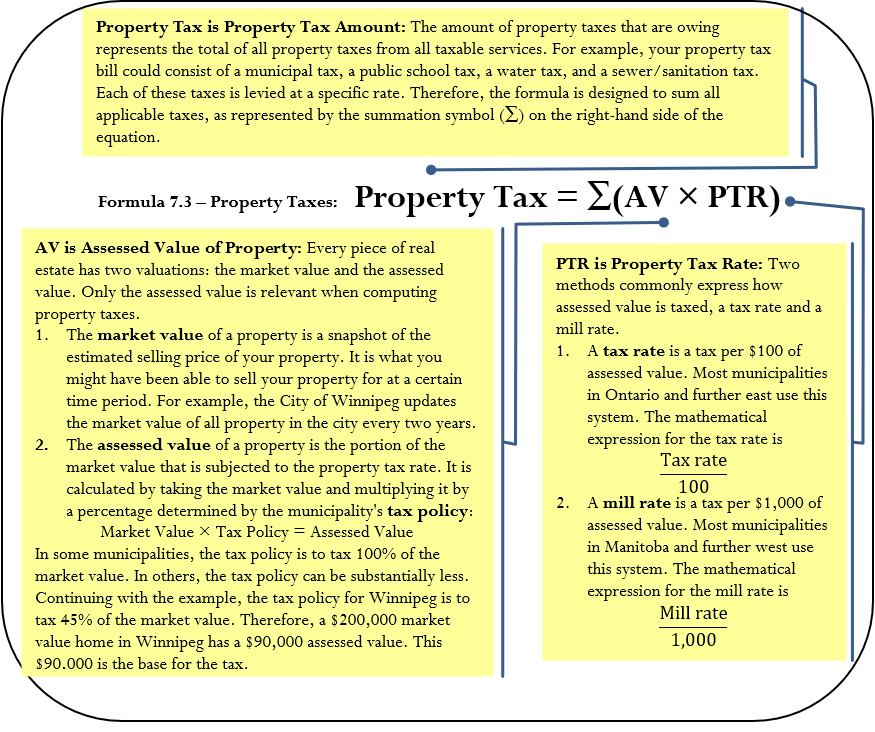

Since property taxes are administered at the municipal level and every municipality has different financial needs, there are a variety of ways to calculate a total property tax bill. Formula 7.3 is designed to be flexible to meet the varying needs of municipal tax calculations throughout Canada.

How It Works

Follow these steps when working with calculations involving property taxes:

Step 1: Identify all known variables. This includes the market value, tax policy, assessed value, all property tax rates, and the total property taxes.

Step 2: If you know the assessed value, skip this step. Otherwise, calculate the assessed value of the property by multiplying the market value and the tax policy.

Step 3: Calculate either the tax amount for each property tax levy or the grand total of all property taxes by applying Formula 7.3.

Continuing with the Winnipeg example in which a home has a market value of $200,000, the tax policy of Winnipeg is to tax 45% of the market value. A Winnipegger receives a property tax levy from both the City of Winnipeg itself and the local school board. The mill rates are set at 14.6 and 16.724, respectively. Calculate the total property tax bill.

Step 1: The known variables are market value = $200,000, tax policy = 45%, City of Winnipeg mill rate = 14.6, and school board mill rate = 16.724.

Step 2: Calculate the assessed value by taking the market value of $200,000 and multiplying by the tax policy of 45%, or

Assessed Value \(=\$ 200,000 \times 45 \%=\$ 90,000\)

Step 3: To calculate each property tax, apply Formula 7.3.

The City of Winnipeg Property Tax \(=\$ 90,000 \times 14.6 \div 1,000=\$ 1,314\)

The school board Property Tax \(=\$ 90,000 \times 16.724 \div 1,000=\$ 1,505.16 = $1,505.16\)

Add these separate taxes together to arrive at

Total Property Tax \(=\$ 1,314+\$ 1,505.16=\$ 2,819.16\)

Important Notes

Mill rates are commonly expressed with four decimals and tax rates are expressed with six decimals. Although some municipalities use other standards, this text uses these common formats in its rounding rules. In addition, each property tax levied against the property owner is a separate tax. Therefore, you must round each property tax to two decimals before summing the grand total property tax.

Things To Watch Out For

The most common mistake is to use the wrong denominator in the tax calculation. Ensure that you read the question accurately, noting which term it uses, tax rate or mill rate. If neither appears, remember that Ontario eastward uses tax rates and Manitoba westward uses mill rates.

A second common mistake is to add multiple property tax rates together when the assessed value remains constant across all taxable elements. For example, if the assessed value of $250,000 is used for two tax rates of 2.168975 and 1.015566, you may be tempted to sum the rates, which would yield a rate of 3.184541. This does not always work and may produce a small error (a penny or two) since each tax is itemized on a tax bill. You must round each individual tax to two decimals before summing to the total property tax.

A residence has a market value of $340,000. The municipality's tax policy is set at 70%. Real estate owners have to pay three separate taxes: the municipality tax, a library tax, and an education tax. The tax rates for each are set at 1.311666, 0.007383, and 0.842988, respectively. Calculate the total property tax bill for the residence.

Solution

Calculate the total property tax for the residence by summing the assessed value multiplied by the respective tax rates.

What You Already Know

Step 1:

The house, tax policy, and tax rates are known:

Market Value = $340,000

Tax Policy = 70%

Municipal PTR = 1.311666

Library PTR = 0.007383

Education PTR = 0.842988

How You Will Get There

Step 2:

Calculate the assessed value (\(AV\)) by taking the market value and multiplying by the tax policy.

Step 3:

Apply Formula 7.3. Note that this municipality uses a tax rate, so the PTR is divided by 100.

Perform

Step 2:

\(AV = \$340,000 × 70\% = \$340,000 × 0.7 = \$238,000\)

Step 3:

Municipal Tax \(=\$ 238,000 \times \dfrac{1.311666}{100}=\$ 3,121.77\)

Library Tax \(=\$ 238,000 \times \dfrac{0.007383}{100}=\$ 17.57\)

Education Tax \(=\$ 238,000 \times \dfrac{0.842988}{100}=\$ 2,006.31\)

Property Tax \(=\$ 3,121.77+\$ 17.57+\$ 2,006.31= \$ 5,145.65\)

The property owner owes the municipality $3,121.77, the library $17.57, and education $2,006.31 for a total property tax bill of $5,145.65.

Paths To Success

The collective property taxes paid by all of the property owners form either all or part of the operating budget for the municipality. Thus, if a municipality consisted of 1,000 real estate owners each paying $2,000 in property tax, the municipality’s operating income from property taxes is $2,000 × 1,000 = $2,000,000. If the municipality needs a larger budget from property owners, either the assessed values, the mill/tax rate, or some combination of the two needs to increase.

A school board is determining next year's operating budget and calculates that it needs an additional $5 million. Properties in its municipality have an assessed value of $8.455 billion. The current mill rate for the school board is set at 6.1998. If the assessed property values are forecasted to rise by 3% next year, what mill rate should the school set?

Solution

Aim to calculate the new property tax rate (PTR) for next year's mill rate.

What You Already Know

Step 1 (Current Year):

The information about the school board and its municipality are known:

\(AV = \$8.455\) billion

PTR (current mill rate) = 6.1998

\(∆\%\) (to \(AV\) next year) = 3%

Property tax increase needed is $5 million

How You Will Get There

Step 2 (Current Year):

Skip. Calculations are based on assessed values already.

Step 3 (Current Year):

Calculate the school board's current budget using Formula 7.3. The property tax collected is the board’s operating budget.

Step 1 (Next Year):

Increase the budget, or Property Tax, for next year. Also increase the current assessed value base by applying Formula 3.1 (percent change), rearranging to solve for New. The current \(AV\) is the Old value.

Step 2 (Next Year):

The assessed values are known. Skip this step.

Step 3 (Next Year):

Recalculate the new mill rate using the new Property Tax and new Assessed Value from step 1 (Next Year). Apply Formula 7.3 and solve for the mill rate in the PTR.

Step 3 (Current Year):

Property Tax \(=\$ 8,455,000,000 \times \dfrac{6.1998}{1,000}=\$ 52,419,309\)

Step 1 (Next Year):

Next Year Property Tax \(=\$ 52,419,309+\$ 5,000,000=\$ 57,419,309\)

\[\begin{aligned}

3\%&=\dfrac{\text {New }-\$ 8,455,000,000}{\$ 8,455,000,000}\times 100\\

\$253,650,000&=\text{New}-\$8,455,000,000\\

\$8,708,650,000&=\text{New}=\text {Next Year Assessed Value}

\end{aligned} \nonumber \]

Step 3 (Next Year):

\[\begin{aligned}

\$ 57,419,309&=\$ 8,708,650,000 \times \dfrac{\text { Mill Rate }}{1,000} \\

6.5934&=\text { Mill Rate }

\end{aligned} \nonumber \]

Calculator Instructions

For step 1 (Next Year) only, use the percent change function (\(\Delta \%\)) to calculate the New Assessed Value.

| OLD | NEW | %CH | #PD |

|---|---|---|---|

| 8455000000 | Answer: 8,708,650,000 | 3 | 1 |

The current budget for the school board is $52,419,309, which will be increased to $57,419,309 next year. After the board adjusts for the increased assessed values of the properties, it needs to set the mill rate at 6.5934 next year, which is an increase of 0.4736 mills.